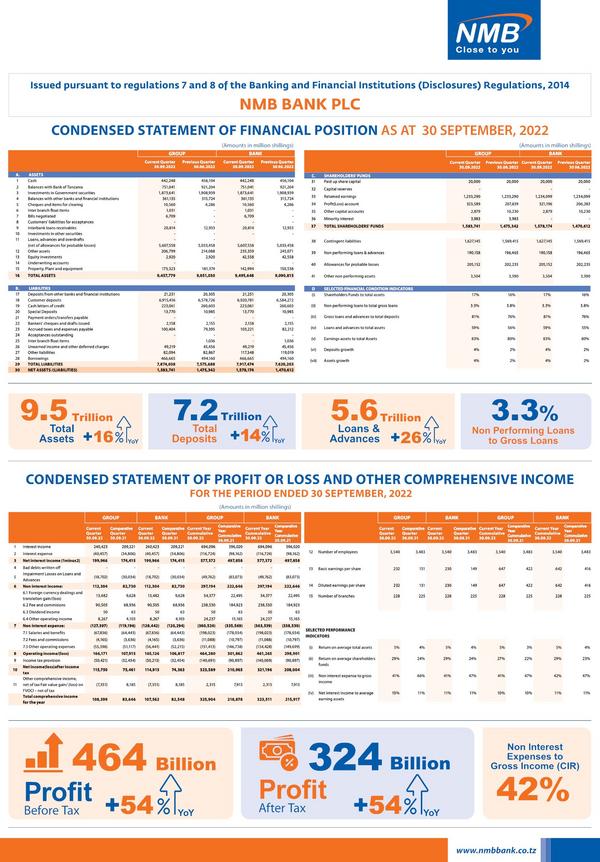

NMB Bank Plc (NMB.tz) Q32022 Interim Report

National Microfinance Bank Plc (NMB.tz) listed on the Dar es Salaam Stock Exchange under the Banking sector has released it’s 2022 interim results for the third quarter.

For more information about National Microfinance Bank Plc (NMB.tz) reports, abridged reports, interim earnings results and earnings presentations visit the National Microfinance Bank Plc (NMB.tz) company page on AfricanFinancials.

Indicative Share Trading Liquidity

The total indicative share trading liquidity for National Microfinance Bank Plc (NMB.tz) in the past 12 months, as of 2nd November 2022, is US$13.03M (TZS32.71B). An average of US$1.09M (TZS2.73B) per month.

National Microfinance Bank Plc 2022 interim results for the third quarter

Company Profile

National Microfinance Bank Plc (NMB) is a commercial bank in Tanzania offering financial solutions for individuals, small-to-medium-sized businesses and large corporations. NMB operates in several segments; wholesale banking, retail banking, agribusiness and treasury. Its product offering ranges from current and savings accounts to time deposits to fixed deposits, and Kilimo, Chap and Chipukizi accounts. NMB also offers loans to entrepreneurs, bank guarantees, and export and import financing, supply chain financing and letters of credit. Other services include forex, cash exchange, institutional and transactional banking, and payment and collection services. NMB has an extensive network of branches and ATMs in the major towns and cities of Tanzania. National Microfinance Bank Plc is listed on the Dar es Salaam Stock Exchange

Recent Documents & News

-

Interim Reports

NMB Bank Plc (NMB.tz) HY2024 Interim Report – January 27, 2025 -

Interim Reports

NMB Bank Plc (NMB.tz) Q32024 Interim Report – November 22, 2024 -

Interim Reports

NMB Bank Plc (NMB.tz) Q12024 Interim Report – October 11, 2024 -

Annual Reports

NMB Bank Plc (NMB.tz) 2023 Annual Report – June 5, 2024 -

Corporate announcement, Dividends

NMB Bank Plc (Tanzania) declares a final dividend of TZS 361.18 per share – May 23, 2024